Let’s work together to find a solution

Rely on AVANA Capital to help preserve your wealth and create growth for your business.

Small and medium-sized enterprises (SMEs) are the bedrock of the US economy. These businesses provide critical, often unseen, support to our growth.

SMEs account for between 60 and 70 percent of all jobs in OECD countries and represent 99.9 percent of all US businesses. Research also shows that SMEs contribute to about half of GDP in most OECD countries. The word “small” belies their influence in the US and the developed world.

Therefore, it’s crucial that these businesses get the financing they need to succeed. Without capital, these businesses and the millions they support are at risk. Today, SMEs face new challenges that are putting their future in question. Recent research from The National Federation of Independent Business (NFIB) concluded that “cost pressures remain the top issue for small business owners” and that “owners are dealing with a rising level of uncertainty.” Unsurprisingly, the NFIB’s Small Business Optimism Index is well below its 50-year average.

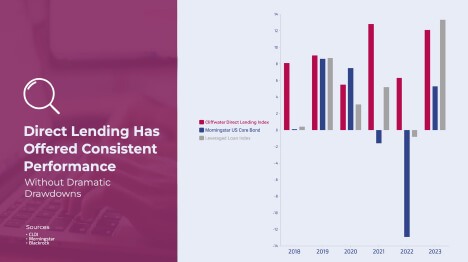

For many SMEs, private credit and non-bank institutions represent an opportunity to access the capital needed to sustain and grow their operations amid uncertainty. The appeal of private credit as a funding option is evident given the sector’s growth from $400 billion to $1 trillion in assets over the last decade. The effectiveness of private credit – also known as direct lending – is clear from the consistent returns of such investments over the years.

Here, we look at how private credit is filling the financing gap for SMEs, why this solution matters, and what the future holds for the relationship between SMEs and private credit.

How Private Credit Supports SMEs

SMEs often have fewer paths to traditional bank loans. Banks usually see them as too small to serve. Therefore, they need a flexible and fast alternative form of financing. Private credit is the answer.

Private credit started to rise in popularity after the 2008 Global Financial Crisis when banks became risk-averse while facing more significant regulations limiting their ability to lend. Moreover, the low interest rates of that environment generated more borrowing, which made private credit even more popular as a financing resource. Data shows that private credit assets under management surged more than 40% in just the two years between 2020 and 2022. The same data set shows that private credit firms held more than $400 billion in undeployed capital as recently as Q4 of last year.

The normalization of private credit in conjunction with available capital means that this source of financing is poised to become a major part of the SME growth playbook.

In the meantime, traditional banks face headwinds that could further restrict their ability to serve SMEs. Recently, US banks have criticized the looming Basel III Endgame reform measure. This regulation, while not yet in effect, would require banks holding more than $100 billion in assets to hold more money in their reserves as a risk-mitigation measure to cover losses. The bottom line is that the largest US banks would need to increase their capital by 15% to 20%.

Importantly, private credit not only supports SMEs by providing otherwise unavailable financing, but it also allows SMEs to hire and expand their operations. In this respect, private credit has a multiplier effect, in which each dollar lent has the potential to generate many more dollars in terms of economic output and even increased spending power among those working at SMEs.

Why Private Credit Matters to SMEs

There are several reasons why private credit matters to SME owners who are often running lean organizations that need to be agile to succeed:

Flexibility: Private credit providers often offer more flexible terms because they can tailor financing solutions to meet the specific needs of SMEs, including customized repayment schedules and structures.

Speed: Private credit transactions can typically be executed faster than traditional bank loans, which often involve extensive paperwork and approval processes.

Access to capital: Private credit often has more relaxed lending standards. Therefore, SMEs can access capital that would otherwise be unavailable via traditional banks with more rigid guidelines. This broader access to capital can be especially valuable for smaller businesses or those with less-established credit histories.

Less regulatory burden: Private credit providers are often subject to less regulatory oversight compared to banks, which can result in fewer compliance requirements and faster decision-making processes. This can be advantageous for SMEs that prefer a more streamlined financing experience.

Customized solutions: Private credit providers can offer various financing options beyond traditional term loans, such as mezzanine financing, asset-based lending, or invoice financing. These alternative structures can be tailored to the unique needs and circumstances of SMEs, providing greater flexibility in managing cash flow and growth.

Relationship-based lending: Borrowers also benefit from the more personalized experience that characterizes private credit financing. Often, fewer lenders are involved in each transaction, making the process more relationship-based. This leads to a deeper understanding of the SME’s business model, challenges, and growth opportunities, resulting in more personalized and supportive financing arrangements.

Mitigation of dilution: Unlike equity financing, which involves giving up ownership stakes in the company, private credit allows SMEs to access capital without diluting existing ownership. This enables entrepreneurs to retain control over their businesses while accessing the funds needed for growth and expansion.

The Future of Private Credit for SMEs

As bank regulations increase and lending standards continue to tighten, private credit will likely continue to grow in popularity as a source of financing for SMEs. There are a few other reasons why private credit will expand its reach:

Technology-driven lending platforms: The rise of (fintech) will continue to facilitate the growth of online lending platforms that connect SMEs with private credit providers. These platforms streamline the borrowing process, making it easier and faster for SMEs to access capital from a diverse range of lenders.

Investor appetite for alternative assets: Institutional investors, such as pension funds, insurance companies, and private equity firms, have shown increasing interest in alternative assets like private credit. These investors are attracted to the potentially higher yields and portfolio diversification benefits of private credit investments, leading to greater availability of capital for SMEs.

Economic uncertainty and market volatility: During periods of economic uncertainty or market volatility, SMEs may face challenges accessing traditional bank financing. With their greater flexibility and risk tolerance, private credit providers can fill this gap by providing capital to SMEs when other sources may be more constrained.

________________________

At AVANA, we believe that SMEs are the heart of the economy. Our high-touch approach makes us more than a funding source. We develop partnerships with borrowers, giving them access to the full range of services we offer. AVANA provides the speed, tailored flexibility, and ongoing support that enables borrowers to put capital to use efficiently. Our 150+ years of combined experience has empowered businesses to succeed in commercial real estate sectors like hospitality, multifamily, industrial/self-storage and clean energy. For more information on AVANA Companies and our investment opportunities, please contact Cathy Ellsworth, EVP-Investor Relations (cathy.ellsworth@avanacompanies.com)